This resource covers the information you need to start your own law practice. The goal of this guide is to (1) help you understand what small business ownership entails; (2) give you a roadmap for the steps required to establish your law firm; (3) provide guidance and templates to help you transition.

Learning Objectives

This resource will cover the following topics:

- Your professional obligations for law firm business ownership.

- The necessary steps and best practices for establishing a law firm.

- The key components of operating a new law firm practice.

Is This Guide for Me?

What It Involves:

Starting a law firm is a major business decision, and this guide offers the fundamental considerations for a small firm business owner.

What Could Go Wrong:

Failing to manage your business properly can expose you to disciplinary complaints or malpractice issues.

You're Vulnerable If:

- You have not created a business plan.

- You are not familiar with law firm business operations.

What You Can Do:

- Reflect on the goals for your practice and the market that you will be operating in.

- Make sure you understand conflicts, fees, and fee agreements.

- Utilize the templates referenced here.

Law Firm Business Ownership: Is it for You?

For some members reviewing this guide may already know that they intend to start their own practice. If that includes you, you may want to move on to the next section.

For members who are still evaluating whether solo or small firm ownership is for them, the following content will walk you through some of the issues you want to consider.

Becoming a Law Firm Business Owner

Whether you have years of practice, or you are just getting started, the decision to start your own law firm means you will likely become exposed to issues you have not had to consider before.

In addition to the challenges of practicing law, you are also signing yourself up for the responsibility of managing and operating a small business. If you have not owned your own business before, you probably did not have to worry about the day-to-day functions of the business or organization where you worked. Suddenly you will become very aware of the cost of supplies, the hassles of billing and invoicing, and the pressure to bring in revenue so the lights can stay on.

Many legal professionals who transition to owning their own practice find that the autonomy and flexibility are worth the challenge. They are entrepreneurs at heart, and find that the opportunity to make their own decisions is rewarding. The financial benefit can also be an incentive— small firm ownership means that you have less overhead and costs consuming your revenue, meaning that you have the potential to bring home more income for the same work. It may also mean that you have more autonomy to lower your fees or provide pro bono services.

However, law firm ownership also carries risks and additional obstacles. As you consider whether you want to start your own practice, consider these common challenges:

1. Revenue may be slow to generate. During the first several years of new law firm ownership, your revenue stream may be sporadic and unreliable. You may find that you are not able to bring in enough work to pay yourself the income you would like, and you may even find it difficult to cover your basic living expenses. This is especially true during the first 6–12 months of your new business.

Factors that will mitigate this lag time, or potentially eliminate it, include (1) whether or not you have an existing book of business that will follow you, (2) whether you have prior experience, (3) the existing network or contacts that you can leverage for referrals, and (4) the market for your niche and your prospective client demographic.

Your prospective client demographic is the type of client to whom you will offer services. If your practice area focuses on consumers or small businesses (versus larger entities) and involves an area of law that is in high demand, you may find that you are able to build your client base relatively quickly. On the other hand, if you are competing with other firms to offer services in a highly competitive area of the law, you will need to work harder to bring in clients and it may take longer to reach a stable revenue stream.>

2. You lose the benefits of employment. If you are working now, your compensation includes not only your salary but also any benefits you receive such as healthcare coverage, retirement funding, employee assistance programs, etc. You may also have an employer that pays for your malpractice insurance. For some new business owners, these costs are too high to sustain initially and so they may take the risk of foregoing coverage or financial security. That may be a rational decision for you so that you can ultimately achieve your goals of being a successful entrepreneur. Ultimately, your risk tolerance will determine how you want to address these issues.

The WSBA provides some resources to help alleviate the impact of self-employment. See “WSBA Member Resources” below.

3. You may be lonely. Owning your own practice can be refreshing. You have the opportunity to schedule your day around the things that matter to you, and you are able to determine the scope of your work. However, the drawback is that you lose the benefit of working on a team or with a large group of peers, especially if you decide to become a solo practitioner. If you know that you do not do well on your own and need the stimulation of interacting with people often,consider some of these workarounds:

- Office Suite: Even as a solo or small firm, you may be able to sublease office space from another firm. Depending on the office culture, you may have the opportunity to interact with members of the firm and build relationships, while still preserving the autonomy of your own practice.

- Co-Working Spaces: For attorneys near metropolitan areas, there may be a co-working space that you can join. Membership often involves a monthly fee. Co-working spaces usually offer open workspaces, private offices, and conference rooms on a subscription basis. They usually offer other amenities like internet access, reception, mail service, and coffee. You can choose to work there every day, or use the service only on days that you want to

- Community: If you are not necessarily in a position where you would need to spend time with other people every day, but you would like opportunities to connect with other professionals on a semi-regular basis, consider joining a local interest group or volunteering for an organization in your area. The Washington State Bar Association offers many opportunities to serve on boards and panels. Another benefit of volunteering or connecting with community groups is that you may also develop a referral network for your practice.

All of these solutions are discussed in more detail below in the “Consider the Logistics for Your Office” section.

4. Your time may be consumed with mundane tasks. Owning a business involves tasks that some may find dull and repetitive. While you may be able to delegate some parts (by hiring a bookkeeper, etc.), you are ultimately responsible for those tasks. Failing to supervise your business administration properly will not only affect the financial health and longevity of your business, but it will also put you at risk of malpractice and professional discipline issues. If you do not like activities such as reviewing expenses, balancing budgets, or reconciling reports, owning your own business may not be for you. If you are not interested in performing legal administrative work (calendaring and tracking deadlines, answering phones, responding to emails, processing correspondence) you can get by with support staff, but that will include a significant expense that a new practice may have trouble sustaining.

5. You may be your own worst boss. One of the benefits (and downsides) of working at a firm or working for an organization is that you have outside pressure to produce work. You do not want to let your teammates down, or you are worried about losing your job if you do not meet a particular quota. The desire to avoid the stress and anxiety of that pressure may even be a factor in your decision to start your own practice. Being accountable to just yourself and your clients sounds much better.

In reality, for some solo and small firm business owners the inverse can be just as challenging. If you do not have the same accountability, it may be harder to follow important routines such as recording your time regularly, sending out invoices on a consistent basis, or meeting your revenue goals. Of course, you still owe a duty to your client and ultimately, a failure to run your business consistently may expose you to liability and professional discipline. But, in the meantime, poor consistency will cause you to experience higher stress caused by the anxiety of evading routines.

Another challenge of working for yourself is a tendency to under value your services. When you have a strong desire to help others or deliver value, you may find that you have a tendency to discount your time or undervalue the actual cost of the work you are performing. Of course, offering low-cost legal services is an important issue for access to justice, and it can be a successful business model. If you are making this decision consciously in the full scope of your business management strategy, you are offering a valuable resource to the public. On the other hand, for some practitioners the decision to discount or devalue their services is not intentional. It may be caused by a failure to accurately identify the scope of work, the desire to retain a client, or a general discomfort with value billing. If you are not intentional about valuing your services, you will undermine the longevity of your business.

Reading this list, you may feel like the list is an attempt to convince you not to open your own law firm. It is not. The intention of this guide is to give you all the information you need to make an informed decision, so that when you decide to start your own law firm you can do so with the knowledge that you have considered the potential obstacles and are prepared to navigate them successfully.

For a worksheet that is designed to help you consider starting a practice, visit www.wsba.org/guides.

Preparing For Business Ownership

After you've evaluated your situation and determined that you want to start your own law firm, the next step is to understand the logistics of actually opening a practice.

Create a Business Plan

To begin the process of establishing your own practice, you should begin by creating a business plan.

A business plan does not have to be extremely complicated, and it can take whatever form makes sense to you. An effective business plan will:

1. Set a vision for you and your practice.

2. Create measurable targets to which you can aspire.

3. Identify your motivations for business ownership.

For a worksheet to help you develop your business plan, see the included template.

Consider Your Options for Fee Models

Another fundamental aspect of law firm planning is identifying the fee types and amounts that you intend to start out with.

Your choice of fee structure is informed by the Washington Supreme Court’s Rules of Professional Conduct. First, you are precluded from depositing client funds into your own business operating account. Therefore, if you intend to require a client fee deposit (an advance fee deposit from your client before fees are earned) then you need to establish an IOLTA trust account under RPC 1.15A. You also need to establish an IOLTA trust account if there is a chance you will receive settlement payments or other funds on behalf of a client.

Furthermore, if you wish to establish a contingency-fee arrangement with a client (where payment is based on the outcome of a matter), RPC 1.5(c) spells out the requirements for contingent fees and RPC 1.5(d) limits the areas (no criminal cases, some domestic relations matters) for which you are permitted to collect a contingent fee.

Finally, RPC 1.5(a) requires that all of your fees must be reasonable.

The next section contains a table of options for fees (not including costs) for your practice. In determining your fee model, you do not need to adopt one model and exclude the others. Depending on the nature of your work, you may decide to offer a hybrid option, with a combination of flat fees and billable hours.

Law Firm Fee Options

BILLABLE HOUR |

FLAT FEE |

RETAINER |

CONTINGENT FEE |

Description

On a billable hour model, you charge clients based on the time expended on the client matter, usually in increments of one-tenth of an hour.

Flat fees are payments made to cover the entire cost of the legal representation.

A retainer is not an advance fee deposit, but instead is a fee paid for the availability of the lawyer or firm during a specific time period.

A fee is contingent on the outcome of a matter.

Related RPCs

RPC 1.5 generally; RPC 1.15A for advance fee deposits

RPC 1.5(f)(2) Note the specific language required in the written flat fee agreements.

RPC 1.5(f)(1); comment 13

RPC 1.5(c) and (d)

Pros

- Direct tie to the labor costs of the firm.

- Model is flexible for uncertain projects (such as litigation).

- Attractive to clients who want more certainty on the amount. More certainty for cash flow.

- May incentivize efficiency.

Provides a sense of security for clients who may want to ensure your availability.

Attractive to clients who want to predicate payment for services on the outcome of their case.

Cons

- May be a disincentive to efficiency.

- > Creates less cost certainty for clients.

- May result in unpaid accountsreceivable.

- Firm acquires the risk of uncertainty of the projected time expended. (For example, if the matter takes more labor than expected, price is the same).

- If the legal professional-client relationship is terminated early, the client may or may not have a right to a refund of a portion of the fee.

- You need to make sure you are available when needed, potentially foregoing other opportunities.

- Clients will have to pay for legal services over and above the retainer.

- Not available for all practice areas or matters.

- Firm assumes the risk of losing money for time spent if the contingent outcome is not achieved.

Tips

- Require advance fee deposits to ensure payment (and remember, if a client cannot afford an advance fee deposit, they may not be able to afford the bill later).

- Require a replenishing of the advance fee deposit when the deposit is fully earned and withdrawn, if applicable.

- Where possible, maximize cost efficiencies by leveraging administrative support.

- Track your time so you can closely monitor project estimates v. actuals.

- Utilize processes and workflows to maximize efficiency.

- Memorialize the limitations of a retainer in writing, and do not provide legal services without a separate agreement for fees and costs.

- Offer retainers only when you are confident you will be available during the agreed timeframe.

- Make sure your engagement agreement is very clear about costs and other fees that the client is still responsible for paying.

- Make sure you keep track of your time in case your employment by the client is terminated.

Isn’t an Advance Fee Deposit a Retainer?

In short, no. An advance fee deposit is a deposit that remains the client’s property until it is earned. Typically, an advance fee deposit is remitted by the client at the inception of the case, or in advance of a major case mile marker (such as mediation or trial). These funds are deposited into the firm’s trust account and held for the client’s benefit. Once the client is billed, they may choose to pay an invoice with funds from their trust account.

In contrast, a retainer is a set amount that is paid to ensure that a firm or lawyer are available during a specified period of time. A retainer fee does not cover legal fees or costs. In most cases, a retainer payment is earned upon receipt and deposited into the firm’s business account.

For information about client trust accounts and fees, check out the WSBA’s Managing Client Trust Accounts guide. For an example of an IOLTA register, see the included template.

Determine Your Business Structure

As a law firm business owner, you are subject not only to the Washington Supreme Court’s Rules of Professional Conduct for attorneys, but you are also subject to the laws regulating business ownership and the provision of professional services. This can have tax, liability, and other considerations.

The WSBA does not offer legal advice, so you should familiarize yourself with the legal implications of your new business. It is strongly recommended that you seek consultation from a certified public accountant as well as a business entity lawyer.

In the meantime, you may find these resources from the State of Washington to be helpful:

- Business.WA.gov | Small Business Guide

- ORIA.WA.gov | Small Business Guide

- Washington State Department of Revenue | Business Licensing Wizard

- Washington Secretary of State | Washington State Business Structures

Understand Your WSBA Licensing Obligations

The Washington State Bar Association does not regulate law firm entities, so you do not need to register your new business entity with the WSBA.

However, you are obligated to keep the following information in your WSBA licensing profile up-to-date:

- Address and contact information

- Malpractice insurance status

- IOLTA account information, if applicable

If your new business creates any changes in these categories, you should update your WSBA license by visiting www.myWSBA.org.

You also have obligations regarding the naming and promotion of your firm. For more on this, see RPC 7.1 (Communications Concerning a Lawyers Services), 7.5 (Firm Names and Letterheads), etc. If you have any questions about your professional responsibility, contact the WSBA Ethics Line at (206) 727-8284.

Consider the Logistics for Your Office

When preparing to open your new business, one of the primary considerations is where you will work and where you will meet clients. Depending on where you are in your career and the financial resources available to you, it may not be feasible for you to start with a traditional brick-and mortar law firm office. Even if you are more established, you may decide that a home office is preferable.

WSBA members are not required to operate their office from a physical office address.1

Law Office Settings

The following are different options for your law office setting:

LESS TRADITIONAL

COWORKING SPACE |

You pay a fee to have access to a coworking space shared with other businesses. You can reserve office space or conference room space as needed.

VIRTUAL OFFICE |

You work from a home office or remotely. Most of your client interactions are by phone or email. You may travel to the client for in-person meetings.

MORE TRADITIONAL

HOME OFFICE |

You have a home office space where you work, but it may be set up to accept client meetings or for other employees to work there as well.

OFFICE SHARING |

You sublet an office, or offices, from another business (usually another law firm). You may receive reception and mailing services.

STANDARD OFFICE |

You rent or own a standalone office suite or office space.

Each option carries its own pros and cons, and your decision will depend on your goals and priorities (i.e. reducing overhead, increasing administrative support, etc.). For any office setting that you choose, you need to take precautions to preserve client confidentiality and avoid confusion.

Preserving confidentiality includes protecting physical files, assuring private conversations, and restricting access to all information. It also includes protecting electronic information and files, including information that is transmitted over the internet.

You are responsible for ensuring that you do not mislead prospective clients, opposing counsel, clients, and others about your office. If you are in an office-sharing setting, you must be cautious to avoid leading anyone to believe you are associated with a firm when you are not. If you have a virtual office, you cannot imply that you have a physical office location if you do not have one.

Identify Your Equipment and Software Needs

Once you have determined your office setting, you can identify the equipment and supplies you will need in order to practice. There are a few core needs for any law firm, but otherwise the nature of your practice will determine what you need to get started on day one.

Computing Equipment

Arguably, a computer is an absolute must-have for your practice. Electronic communication, electronic filing, and client expectations will likely require you to have a computer of your own. It will also mean that you are going to be able to operate more efficiently.

With that said, you have options for your computer setup. You do not necessarily need a traditional desktop setup (computer tower, monitors, standalone keyboard) but you should consider what equipment will be suited to your needs.

You should consider how often you would need to work away from your primary workspace. If you plan to work remotely often, a laptop will be necessary. With a laptop, you can still enjoy a traditional desktop setup by using a docking station.

In terms of brand, you should look at consumer reviews to figure out what will work best for you. However, one caveat to this is Google Chromebook—you are only able to obtain Microsoft Office products on a Chromebook as a mobile application. This will significantly reduce the functions that are available to you. Depending on your practice, this may be less of an issue for you. But most practitioners will need the full features of Microsoft Office Suite; purchasing a Chromebook may not be an option.

Scanner/Printer/Shredder

Depending on your practice area, you will need to purchase or lease equipment to print, scan, or copy paper. If you have a practice that requires you to produce a high volume of hard copies (perhaps large discovery productions, trial exhibits, etc.), then you will need access to a commercial copier system.

If you do not need to produce a high volume of documents, or if you can produce documents electronically, then you can make do with a desktop printer/scanner. When shopping for your equipment, look for features such as the capacity limits, the speed, and the maintenance costs (ink cartridges, etc.).

Remember that you will also need to process paper that you receive, so even if you manage your files electronically, you may still need equipment that can handle documents you receive from clients, opposing counsel, and others.

Finally, you need to have a system to dispose of physical files securely. You may be able to do this with an office shredder, or if you process a lot of physical files you will need to sign up for a commercial shredding service.

Telephone Systems

Depending on the hardware choices you make in the early planning stages of your firm, you may decide not to purchase or rent a telephone landline system and rely on your mobile phone for telephonic communication. This works as long as you have reliable cellular service where you are working.

For some legal professionals, providing your personal cell phone number can be unsustainable. You may want to create a stronger boundary between work and your personal life, or you may feel uncomfortable giving your personal information to clients.

Fortunately, there are plenty of services that will give you a private number for little or no cost. Usually these work by allowing the caller to dial the number assigned to you, but it is set to automatically forward to your cell phone or other device so that the caller does not have your personal number.

A few examples include:

Google Voice. Phone option for G Suite for business.

Microsoft Skype Number. Generate a number that you can share and answer from the Skype application.

RingCentral. Some plans include internet faxing.

Of course, before selecting any vendor for your telephone service you should familiarize yourself with the privacy and terms of the vendor, and make sure it is consistent with your professional responsibility to preserve client confidentiality.

Equipment You Do Not Need

With changes in technology, you can likely avoid having to purchase or rent this equipment:

1. Fax Machine: some practices still need access to a fax service in order to communicate. However, you do not need a physical fax machine to accomplish this, and you can use electronic fax services to receive and transmit faxes.

2. Landline phone: With voice systems now, you can assign a business phone line to your mobile phone so you do not need to purchase telephone hardware. However, if you work in a location that does not receive good cell service it may become unsustainable over time to go without a landline phone.

Software

When you are first starting out, you can make do with a minimal amount of software and services. The following may be what you need on a minimal level:

1. Virtual Private Network: If you will use public Wi-Fi (such as wireless internet access at a coffee shop, hotel, or airport) to send or receive email, then you need to acquire a Virtual Private Network for any devices (laptop and mobile phones) that you will use. Typically, this requires a monthly fee and you install an application that automatically protects your public Wi-Fi connections.

2. Professional Email Service: There are many options for you to host your email service, but one thing you probably do not want to do is use a free email service that is intended for personal use. Typically with technology, if the service is free that means you are “paying” for it somehow, usually by allowing the company to collect information about you to sell to advertisers. For legal practitioners, this means that you could be exposing confidential information. To avoid this issue, make sure you understand the terms of any service you sign up for, and consider signing up for a paid, professional service (such as Google Business) that is zero-knowledge (meaning, they do not access your information).

3. Office 365: Word processing applications come in many forms, such as Google Docs, Apple’s Pages, or freeware like OpenOffice Writer.2 Most of these will meet your basic word processing needs, and some of them are available for free. However, if you have a practice that requires you to create many documents or use more sophisticated features, you should probably just obtain a subscription to Microsoft Office 365. This will give you access to Microsoft Word, Excel, and Outlook, as well as cloud-storage with OneDrive.

Optional Software and Equipment

While you do not necessarily have to start out with these tools, there are many technology and software options that can help streamline the administrative burden of law office management:

1. Accounting software, such as QuickBooks

2. Practice management software

3. Time-tracking software (may come standard with accounting software or practice management software)

4. Customer relationship management software

5. Dictation software

6. Scheduling applications

Business SMS Services

You should also consider whether you want to offer the benefit of text services to your client. If you do, it is highly recommended that you do not provide your personal cell phone number and send text messages through your normal messaging app.

Instead, you can use a commercial texting service (or “Business SMS Service”) that will permit your clients to send a text message from their mobile device, and the message is directed to a specific portal where you can review and respond to messages. The benefit of this approach is that you are able to keep a better record of your correspondence. It will also help you avoid mistakes by separating your SMS messaging from your personal applications.

Considerations for a business SMS service include:

1. Adequate Security Practices. You should be aware of what data is collected and stored by the SMS service, and how that data is protected. You should also ensure that the service has functionality for clients to opt-in and opt-out easily. For more information about cybersecurity considerations, visit www.wsba.org/pma.

2. Functionality and Integration. With any software service, you want to make sure that you are not duplicating data management efforts. That means that you want a service that integrates with other software you use to track client contact information and other case-related information. For example, if your client changes their phone number, you should be able to make that change once and have it reflected across all of your software tools.

3. Automation. Text messages can be great for transitory information like appointment reminders, or notifications to a client about a new bill is waiting for their review. Consider the ways you can use an SMS service to automate communications to help keep clients informed.

Note that state and federal laws may regulate text messaging to consumers, especially unsolicited text correspondence. You should obtain permission from the client before you text them, and always use a service that offers the ability to easily opt-out.

Create Your Law Firm Budget

Once you’ve performed all the previous steps of creating your business plan; figuring out licensing, logistics, and equipment; and considering your options for fees, you are ready to develop a preliminary budget to help you anticipate your operating costs and revenue needs.

For an example budgeting template, visit www.wsba.org/guides. You need to do research to determine what expenses you can anticipate, and should consult with an accountant for any considerations regarding your business expenses or taxes. The budget template cannot serve as a replacement for accounting advice, but it can give you a rough estimate of your business needs and revenue goals.

Your First Six Months

The Basic Fundamentals of Operating Your New Law Firm

Malpractice and discipline issues can be caused by bad legal skills. These issues can also arise when attorneys have poor administrative policies and practices. In order to start your practice off right, there are basic management practices that you need to adopt.

Avoid Conflicts of Interest

You cannot represent a client if that representation would implicate a conflict of interest.3 For solo and small firm attorneys, it is critical that you have a viable method to perform conflict checks, record client information for future conflict checks, and maintain a record of conflict checks that you perform.

A basic conflict recording system should include information about the relevant parties in a case, including your client, the opposing party, and related entities or parties (e.g. closely-held businesses).

For a template to record conflict check information, visit www.wsba.org/guides.

You should complete a conflict check when a prospective client contacts your firm, and before you discuss any details related to their legal issue. If you ever encounter a conflict of interest and need assistance navigating your professional obligations, please contact the Ethics Line at (206) 727-8284.

Use Written Engagement Agreements; Use Written Termination or Declination Letters

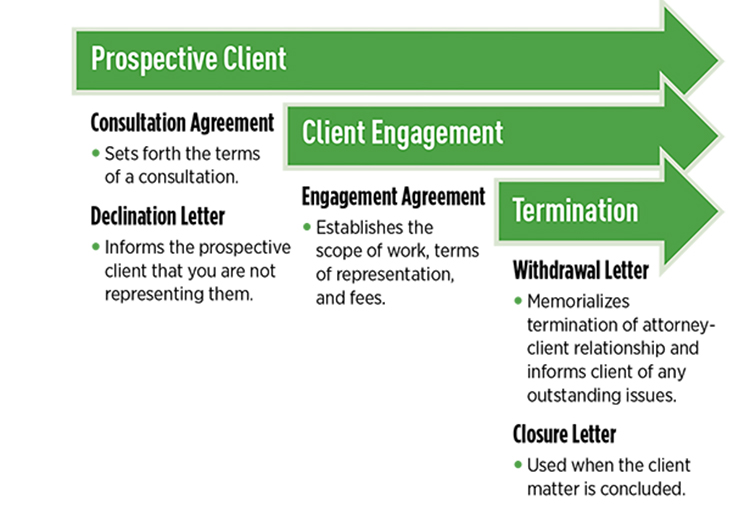

You should memorialize all aspects of the client relationship, including the decision to decline representation of a prospective client.

Prospective Clients

A client-legal professional relationship is formed when a prospective client seeks and receives legal advice.4 It is not necessarily required that a written contract is executed; an attorney-client relationship can be implied based on the conduct of the lawyer and the prospective client. It also is not required that a fee is paid. Ultimately, although it must be reasonable in light of the circumstances, the client’s subjective belief that an attorney-client relationship exists will dictate the start of an attorney-client relationship.

To avoid the creation of a relationship when you do not intend it, you should take precautions to keep a prospective client informed about the limitations of your communication.

One thing you should do is require a written consultation agreement, even if you offer free consultations.

Even if you have a consultation agreement, you should also provide written notice to a prospective client if you do not move forward with representing the client.

4 See Bohn v. Cody, 119 Wash.2d 357, 363 (1992).

Client Engagement

Once you and the client agree that you will represent them, you should memorialize all of the terms associated with the representation in writing. You should require your client signs the agreement before the engagement commences. You should also ensure payment of any deposits or fees that are owed in advance as soon as the engagement commences.

5 See RPC 1.16 for information about withdrawing from a client matter.

Declination or Termination

After the client has retained you to represent them, you should memorialize any changes in the relationship. That includes termination of the relationship (in the event you decline to continue representing the client, or the client no longer wants you to represent them).5 It also includes the natural end of the relationship once the matter is resolved or concluded. This is important because you want the client to understand that you are no longer representing them, and will no longer perform work on the client’s behalf.

Manage Your Timekeeping, Billing, and Invoicing

A key obligation for owning your own law firm is that you are now responsible for overseeing the billing lifecycle of a client matter. While you may have an assistant or professional to help you with your bookkeeping, you are ultimately responsible for ensuring that your firm follows best practices for client billing and invoicing.

First, you need a consistent way to track your time. This is true regardless of whether your firm operates on billable hours, flat fees, or contingency, and it is true for legal work as well as administrative tasks that you perform. At the very least, tracking your time will give you insight into how your firm is performing against expectations.

There are many time tracking tools available electronically, some of them are even free or are included with other software. For example, QuickBooks Online has a time-tracking feature that integrates with the rest of its accounting software. Generally, any practice management software will have a time tracker that you can use.

If you would like to start with basics by tracking your time more manually, you can download the template.

In addition to tracking your time, if you operate on billable hour model, you need to provide regular invoices to the client and keep a ledger of any deposits that you hold in advance.

Track Deadlines and Deliverables

A common source of disciplinary or malpractice issues is a failure to meet deadlines. This can include big deadlines—such as a statute of limitations, a motion response deadline, an arbitration brief, etc.—but it also includes deliverable targets that you set with your client. For example, if you tell a client that you will send them a draft by a particular date, are you tracking that deadline for yourself?

As a law firm business owner, you want to create processes so that each case has a protocol that you follow every time. For events that involve many different parts, such as a motion, you want to make sure you have a system for recording each obligation that you have. In developing your process, you want to make sure you structure the process in a way that allows you to project plan. In other words, recording deadlines on a specific document is great, but if you do not have a process by which you are incorporating that into the way you manage your day, it will not be as effective.

Project management is a topic of discussion everywhere, not just the

legal community, so there are many options for you to choose in designing a process that works for you. There are even project management tools designed specifically for law firms. For examples and ideas, check out the WSBA’s Practice Management Discount Network.

If you are not ready to adopt a whole new technology tool, but you want to have some help thinking about a process for tracking deadlines in a more methodical way, download the example spreadsheet for tracking matter deadlines. This template will help you import a collection of deadlines or due dates directly into your Outlook calendar at the same time.

Your 6-Month Check-In

Next Steps

When you are just starting out, you are really only focused on the key issues that you need to get your business up and running. Once you are settled, and preferably within the first 6–12 months of your practice, you should do the following:

1. Review your business plan and identify any changes or missed opportunities

2. Develop and implement a marketing strategy

3. Consider process improvements or opportunities for efficiency

4. Research software and technology that will help you improve your practice management

5. Speak with a WSBA practice management advisor about any questions or concerns you have (visit www.wsba.org/consult to get started).

TL;DR6

Starting your own law firm is a serious decision. Starting a business takes planning to make sure you are prepared to weather an uncertain financial future. You should be aware of the challenges of small business ownership, and be prepared to spend more of your time focused on the day-to-day of marketing, bookkeeping, and administration so that your legal service delivery meets the needs of legal consumers. With these considerations in mind, starting your own practice can give you flexibility and freedom to pursue your goals as a legal professional.

8 A shorthand notation summarizing the content of the materials.

Additional Resources

WSBA Members

For more information and assistance from the WSBA on document retention, consider these resources available to WSBA-licensed legal professionals:

- Free Lending Library: Borrow from a selection of 400 books. You can register immediately online and start placing holds. Titles will be shipped to you automatically. Visit www.wsba.org/library to get started.

- Free Consultations: You can speak with WSBA staff in the Practice Management Assistance Program for personalized advice regarding your law firm business management. Visit www.wsba.org/consult to get started.

- Free Ethics Help: You can speak to WSBA staff regarding questions of ethical obligations or your professional responsibility. The phone number is 800-945-9722.

- Discounts on Software and Services: Through the Practice Management Discount Network, WSBA members receive discounts on a menu of software and services to help you improve your practice and client service delivery. Visit www.wsba.org/discounts to learn more.

For other WSBA resources and member benefits, visit www.wsba.org/MemberSupport.

External Resources

- Business.WA.gov | Small Business Guide

- ORIA.WA.gov | Small Business Guide

- U.S. Small Business Administration | Choose a Business Structure

- Washington State Department of Revenue | Business Licensing

- Washington Secretary of State | Washington State Business Structures Wizard